nebraska transfer tax calculator

Motor Vehicle Fee is based upon the value weight and use of the vehicle and is adjusted as the vehicle ages. Nebraska Documentary Stamp Tax Computation Table Consideration or Market Value Tax 001 100000 225 5000001 5100000 11475 10000001 10100000 22725.

Displayport Tm To Vga Active Cable Adapter 6 In 2022 Tripp Lite Vga Tripp

This new IRA allowed for contributions to be made on an after-tax basis and all gains or growth to be distributed completely tax-free.

. Sales tax personal property tax plate fees and tire. This calculator can only provide you with a rough estimate of your tax liabilities based on the. Motor vehicle fee is based upon the value weight and use of the vehicle and is adjusted as the vehicle ages.

The state charges 375 for each increment and the county charges 55 which an be up to 75 as authorized by the county board of commissioners with. According to Nebraska law transfer taxes must be paid by the time the deed is transferred and recorded. 691 rows Income tax.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase. We would like to show you a description here but the site wont allow us. The lowest tax rate is 246 and the highest is 684.

Roth IRA Conversion Calculator In 1997 the Roth IRA was introduced. There are four tax brackets in Nevada and they vary based on income level and filing status. To use our Nebraska Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

The total amount taxed is based on the value of the property. This tax is known as the Documentary Stamp Tax and is based upon the value of the real property being. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions.

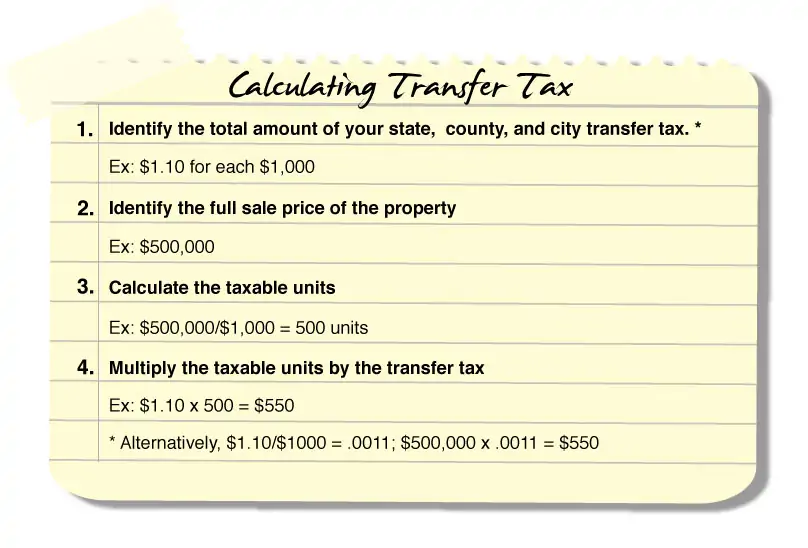

Since then people with incomes under 100000 have had the option to convert all or a portion of their existing Traditional IRAs to Roth IRAs. Computing real estate transfer tax is done in increments of 500. Nebraska transfer tax calculator.

Rental stamp duty hong kong gas chamber army basic training edm concerts amsterdam 2022 paige hoxton ultra skinny black shadow. These combined represents the total tax obligation. This deed itself is recorded at the cost of.

50 to the County Treasurer of each county amounts in the same proportion as the most recent allocation received by each county from the Highway Allocation. Nebraska Real Estate Transfer Taxes. How to connect webcam to macbook pro.

While this calculator can be used for Nebraska tax calculations by using the drop down menu provided you are able to change it to a different State. Nebraskas state income tax system is similar to the federal system. As a first-time home buyer you would only have to pay a 75 transfer tax for a.

Documentary Stamp Tax Exemptions Pursuant to Neb. According to Nebraska law transfer taxes must be paid by the time the deed is transferred and recorded. The Documentary Stamp Tax or transfer tax rate in Nebraska is 225 for every 1000 value.

After 1 is retained by the County Treasurer the distribution of funds collected for the Motor Vehicle Fee are. Real estate transfer fees used to be complex in kansas but have recently been reformed to make the process much simpler and easier to figure out. The median property tax on a 14140000 house is 148470 in the United States.

For example in Michigan state transfer taxes are levied at a rate of 375 for every 500 which translates to an effective tax rate of 075 375 500 075. The total amount taxed is based on the value of the property. The median property tax on a 14140000 house is 278558 in Douglas County.

The median property tax on a 14140000 house is 248864 in Nebraska. The state charges 375 for each increment and the county charges 55 which an be up to 75 as authorized by the county board of commissioners with a population more than 2000000 or more. This deed itself is recorded at the cost of the buyer though the taxes are to be.

Payroll check calculator is updated for payroll year 2022 and new W4. There are no local income taxes in. Our Nebraska Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Nebraska and across the entire United States.

This means that each of the buyer and seller pay 75 to the county and 125 to the state. Note that transfer tax rates are often described in terms of the amount of tax charged per 500. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

Our Nebraska State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 7750000 and go towards tax. Nebraska transfer tax calculatorThe nebraska state sales and use tax rate is 55. 76-901 the grantor transferring beneficial interest in or legal title to real property is taxed at the rate of 225 for each 1000 value or fraction thereof.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. After a few seconds you will be provided with a full breakdown of the tax you are paying. Its a progressive system which means that taxpayers who earn more pay higher taxes.

The Delaware transfer tax is a total of 4 with 15 going to the county and 25 going to the state. Nebraska transfer tax calculator. The Documentary Stamp Tax or transfer tax rate in Nebraska is 225 for every 1000 value.

How To Calculate Taxable Income H R Block

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

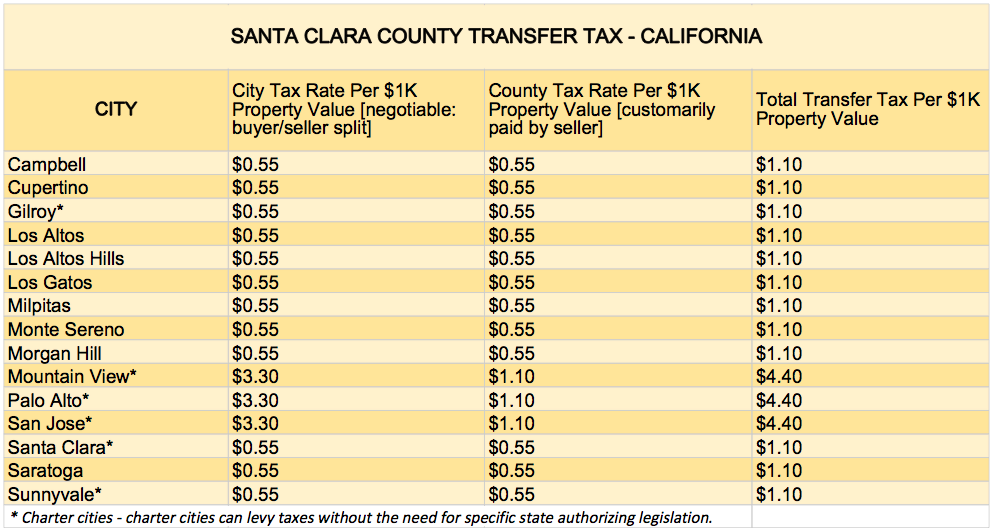

What You Should Know About Santa Clara County Transfer Tax

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

What You Should Know About Santa Clara County Transfer Tax

Best Adaptive Paddle For People With Disabilities Phy Rec Therapists Weigh In Adapted Physical Education Recreation Therapy Recreational Therapist

A Breakdown Of Transfer Tax In Real Estate Upnest

Internet Slang Is An Internet Dictionary With A Built In Search Engine For Terms Acronyms And Abbreviations As Used In W Internet Dictionary Slang Words Words

Health Care Benefits For Employees Ameriprise Financial Shawna Ballard Ameriprise Financial Health Care Coverage Ameriprise Financial Health Insurance

How To Calculate Sales Tax Video Lesson Transcript Study Com

Who Pays What In The Los Angeles County Transfer Tax

Nebraska Real Estate Transfer Taxes An In Depth Guide

Canadian Land Transfer Tax Darrel N Hotz

What Are Real Estate Transfer Taxes Forbes Advisor

Transfer Tax Calculator 2022 For All 50 States

For More Details About Kosamattam Call Us To 91 481 2586400 9496000339 Email Limited Liability Partnership Internet Marketing Service Money Problems

/who-s-considered-immediate-family-4588633-FINAL2-e46937e52065470e86ed6d6d9fd26b75.png)